E.surv has reported that annual price growth has increased to 10.4% in England and Wales, as demand for homes continues to outpace supply.

The average house price is now £372,436, up 1% monthly and 10.4 annually (9.5% up excluding London and the south east of England).

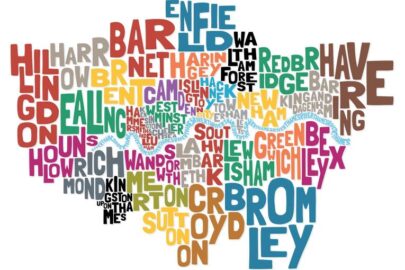

House price growth has re-emerged in Greater London, climbing to 9.9%, while Wales has maintained its place with the highest property price increase of the 10 GOR areas in England and Wales.

Richard Sexton, director at e.surv, said: “This month’s data tells the story of the post pandemic race for space over the last year and the more recent demand for properties that fulfil the demands of hybrid working.

“If we look first at the annual trend, we see Wales remains the area with the highest annual growth rate, a position it has held for nine months. The demand for more rural living has underpinned this. Lifestyle choices and the requirement for more spacious properties that deliver good working-from home conditions are encouraging buyers to reassess their opportunities.

“However, if we examine the monthly performance, Greater London emerges as the area with the largest increase in its growth rate, up from 5.5% last month, to 9.9% this month. We mentioned in our last index that this change was underway, arguably the result of a renewed need for properties that were well connected to London.

“As a result, nationally, the average price paid for a home in England and Wales in April 2022 was £372,436, up some £3,600, or 1.0%, on the average price paid in March. This sets yet another new record level for England and Wales. Prices are now some £35,000, or 10.4%, above April 2021 levels, and show a 2.4% increase over March 2022’s revised annual rate of 8.0% for homes bought with cash or with a mortgage.

“It may be tempting to assume that higher interest rates will impact homebuyers’ aspirations, but rates remain comparatively low and property remains a keen investment too as inflation puts pressure on equities and other asset classes. There is still too little of the right kinds of property available and this will continue to support growth as people reflect and act upon their aspirations for the future and what that means for where they need to live.”