New research from Barclays Mortgages has uncovered that property size and standard measurements are puzzling house hunters.

It says that one in four don’t understand the concept of a square foot or square metre, leading to one in five admitting they have struggled to fit their belongings into their property and over one quarter have had to return furniture that didn’t fit in their new home (28%).

Over half of homeowners and first-time buyers don’t know the size of their home in square foot or square metres. Furthermore, people often overestimate the average size of a UK property (a three-bedroom home). For example, when asked, most Brits believed it to be almost 40% larger than reality (1100 sq ft vs 800 sq ft).

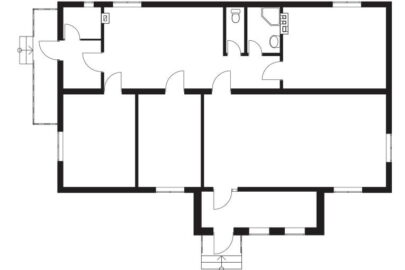

When searching for a new property online, 69% of house hunters don’t look at the floor plans and simply judge a property by its photos. This results in an average of four days wasted looking at properties that are too small.

The survey found that 38% of homeowners wish they had moved into a bigger property than they currently live in and 25% wish at least one of their rooms was larger.

Looking for more room, 37% of homeowners plan to improve their home to create additional space.

Barclays Mortgages also found that 33% stated that the size of the home is more important than the location and 42% would choose to own a larger property over staying in their current area.

This desire for more space comes as two fifths of homeowners experience anxiety when it comes to hosting people in their homes. Two in five surveyed felt worried over the Christmas period about having friends and family to stay due to a lack of space and 15% were concerned their property wasn’t big enough for entertaining in general.

While over one in three plan to prioritise a larger kitchen next time they move, one in ten revealed that, if money was not an issue, they would have a whole room dedicated to their pet. Second and third on the wish list were ensuite bathrooms (38%) and larger bedrooms (37%).

Hannah Bernard, head of mortgages at Barclays, said: “As more of us look for properties online it’s interesting to see how, as a nation, we’re struggling to judge how much space there is. It’s important to think about whether you need more space in a new property or if you can simply extend your home to suit your needs.

“We understand the factors that need to be considered in these circumstances and want to help families stay in control of their finances as they plan for a change in their home – whether it’s a first move, a re-mortgage or home improvements.”