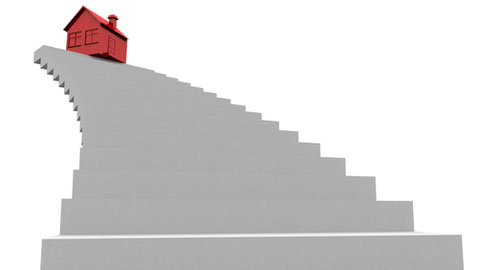

Many homeowners are not progressing up the housing ladder as quickly as they had hoped, with 33% expecting to be further along than they are now, according to new research from Lloyds Bank.

This proportion is even higher for first time buyers, with 44% expecting to have been further up the ladder at this stage.

Meanwhile, 83% believe homeowners have to wait a lot longer to reach their long term family home than they would’ve done a decade ago, with 31% of people worried that their own financial situation will create a barrier to moving.

Despite recent improvements in the housing market, 40% still consider the housing market to be having an impact on aspirations, although this figure has fallen since 2013 (47%) and 2012 (53%). 48% of first time buyers think that the housing market will have an impact on how long it takes them to reach their family home.

Even with anticipated delays in moving up the housing ladder, 44% expect not to make any compromises and believe their long term home is a realistic achievement and 18% expect it to be a better property than their childhood home. 36% hope to achieve their housing aspirations by the time they are 45.

Andy Hulme, mortgages director at Lloyds Bank, said: “Many current homeowners clearly still feel that they are not progressing up the ladder as quickly as they would like, with higher house prices in some regions meaning people are waiting longer to move into to their long term family home.

“Despite this, almost two thirds still believe they’ll be in their long term home in less than five years, with the vast majority thinking this will only require one more move.”

Despite an increase in the number of people feeling they need a bigger property, the house that the majority of homeowners in the UK aspire to own has three bedrooms (43%). 24% want four bedrooms, with many people aspiring to have nice gardens, conservatories and high quality kitchens and bathrooms.

63% of homeowners believe they will reach their long term family home in less than five years. 64% of those who are still waiting to be in their long term home think they will only have to make one more move to achieve their housing aspirations.

The average price of a three bedroom home in 2014 stood at £190,420, with the average total income of the occupants being £46,140.

Applicants for three bed properties, which are seen by many as long term homes, are on average 35 years old in London and the South East. This is a year older than the national average. These regions remain the least affordable in the UK for three bed houses, as a result of the high house prices.

In contrast, long term family homes in the North and Wales are more affordable with the average three bed property costing £129,447 in the North and £135,070 in Wales. Average incomes of the applicants are lower (£38,606 and £36,390 respectively), but long term homes are still more affordable in both regions. As a result the average age of the applicants is lower than the national average (34) in Wales (33) and the same as the national average in the North.