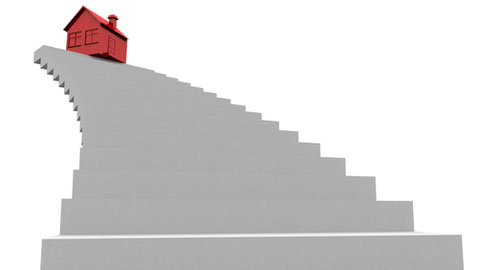

Delays in getting on the housing ladder will cost the average first-time buyer over £270,000 over their lifetime, or twice the cost of a typical first time buyer home, according to independent research by The Model Works.

However, those forced to rent into their retirement could pay even more dearly driving up housing benefits and state long term care costs to truly unsustainable levels, the firm said.

The Model Works has been analysing the growth of the rental market at the expense of the first-time buyer with growing concern.

Back in the 1960s the average age of the first-time buyer was 24. Today, according to Moneysupermarket, it is 37.

Based on market data averaged over 30 years, The Model Works has calculated that the returns from investing all the savings from buying a home at 24 as opposed to 37 could over a lifetime amount to more than £270,000 at today’s value (the calculation assumes a tax efficient savings scheme).

“That first-time buyers are getting older is a well established fact,” says Brian Hall, the founder of The Model Works. “But we believe this is the first time that the full cost to those affected has been quantified and of course millions are affected.”

Mortgage repayments are pegged to the original purchase price, while rents rise over time and so the savings from homebuying increase year on year Buying at 24 also reduces the term spent renting by 13 years, compared with 37. Finally, tax breaks and compound interest over a longer period contribute significantly to the total.

The Model Works said the worse case scenario is to be excluded from homeownership for life, renting in the private rental sector, with rents continuing to rise for decades after the mortgage would have been repaid, finding it difficult to save and unable to accumulate equity.

Auto enrolment in a workplace pension scheme will erode disposable incomes and to this new expense must be added rising rents and student loan repayments, making it even more difficult to save a deposit. But opting out will result in a loss of employer’s contributions. The Model Works will be exploring the options next.

The Model Works previously linked growth in the private rental sector with rising demand for housing benefits and now research by Partnership has found that almost half of homeowners expect to sell or rent their property to pay for their long-term care. Tenants don’t have this option and may require comparable support from the state.

Hall said: “If current trends continue, the total cost of delayed homeownership and exclusion for life could cost the taxpayer tens of billions of pounds per annum and these costs will rise as the retired population is expected to double by 2050.

“I don’t see anyone balancing both sides of the equation when considering initiatives like Help to Buy. The taxpayer is already committed to provide staggering levels of support in the future to those being disadvantaged today.

“Resolving the problems in the homebuilding and home-buying sectors will reduce this amount. Somewhere in all the data and opinion is a simple cost, risk and payback model. Faced with the facts it becomes crystal clear that doing nothing is not an option.”