The Model Works’ latest profitability index for London buy-to-lets has reported that five-year, geared, buy-to-let investments have continued to provide excellent profits with an annual rate of return of 11.43% last quarter.

The index uses Bank of England, Nationwide and Association of Residential Letting Agents data to calculate the historic returns over 25, 20, 15, 10, and five-year periods, for a cash buyer or a geared investor, with a repayment or an interest only mortgage, selling today.

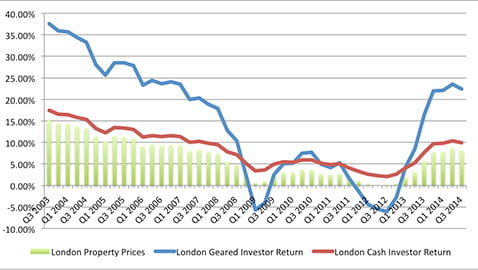

The graph (above) expresses London five-year, cash investor and geared buy-to-let profitability over the past 10 years and five year property price inflation levels expressed as a compound annual rate.

“This is the fourth quarter where returns have exceeded 11%,” said Brian Hall, founder of The Model Works.

“However, for many these returns are a result of continuing property price inflation. To understand what is going on and what might happen in the future, particularly in the volatile London market, we must look beyond the headline figures.”

Hall said cash investors returns in London had been falling from the early 2000s until two years ago, when they began to recover. However, even taking into account overheads, fixed costs and provisions, cash investors have consistently made positive returns from buy-to-let. These have typically been higher than prevailing deposit rates and have not been wholly dependent on property price inflation.

This is not the case for geared investors. The figures have been volatile and even gone negative on two occasions. This unpredictable behavior is a result of gearing (buying the investment with a mortgage) where the ups and downs of property price inflation and rental yields are multiplied.

Hall said: “Given these facts, it is interesting to speculate what will happen if market conditions change, now property prices are beginning to cool, particularly for geared, buy-to-let investors buying today. Because geared investor returns are so dependent on rising property prices, perhaps the limiting factor to continued inflation will be the affordability of rising rents for private sector tenants.

“When the pension system changes next year, many will turn to buy-to-let. This may cause an asset price bubble, but it could also cause competition with an increasing supply of rental properties.

“Yields in London are already lower than the UK generally, at 4.37% versus 5.08%, according to the Association of Residential Letting Agents. With geared investments, even relatively small negatives in the profitability calculations can have a significant adverse effect. Prospective landlords need to consider the widest range of influencing factors when making their investment decisions.”