The effects of six consecutive years of record low interest rates – which have cut older savers’ returns – have been unveiled in new research which reveals that over 60s are most likely to fall into arrears with their water company.

A survey of 1000 randomly selected UK households conducted via USurv in Summer 2015 found that over 60s were most likely to fall into debt, with 30% of this age group reporting they regularly struggle to pay their water bill. This is compared to 16% of 30 – 39 year olds, 10% of 40 – 49 year olds and 5% of 50 – 59 year olds.

An additional two in five of low income families (under £10,000 per year) stated they had fallen into debt with their water company as a result of not paying their bill.

Debt collection agency Grosvenor Services Group is calling for a “fairer approach” to debt collection, particularly amongst vulnerable groups such as the elderly and lower-income families.

Lloyd Birkhead, managing director of Grosvenor Services Group, said: “While it used to be a case of ‘can’t pay, not our problem’, debt collection has become much more ethical in recent years following heightened governance and FCA requirements. Unsecured debt in the UK stands at £173 billion and there’s no sign of that decreasing. With an increasing number of people in debt, it’s not appropriate or ethical to treat a customer that is in arrears like a naughty child.

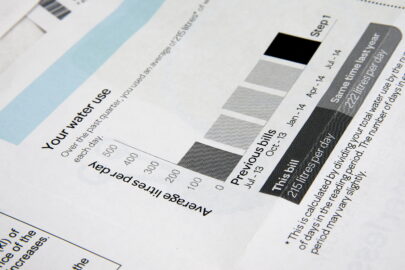

“There are a number of reasons why a customer might not pay a bill, some of which traditional debt collection strategies simply don’t take into account. For example, people who wont pay their bills because they’re wrong, they don’t understand them, or they’ve arrived late, is an increasingly common occurrence. Here, it’s not a case of a customer who ‘can’t pay’, but rather ‘won’t pay’ due to issues that they consider not of their making. Having joined up systems that recognise this throughout the debt cycle is vital.

“We know how crucial it is to understand each customer’s case individually, and work with them to devise a fair and achievable repayment plan, rather than deploying a single strategy for all customers. Over the years, we have created specialist processes and departments for liaising with vulnerable customers that have been developed over considerable time. However, before any of this is put into place, companies should ensure that the debt they are collecting is genuine and customer issues are solved wherever they can be before debt collectors are appointed.”